[AA/F8: Tài liệu ôn thi] Part B: Planning and Risk Assessment

Part B sẽ ôn lại 4 dạng bài tập quan trọng môn Audit & Assurance (F8) với chủ đề Planning and Risk Assessment.

1. Tổng quan:

|

Topic |

Question types |

Question index |

|

|

MCQ |

Case |

||

Planning and Risk Assessment |

1. Risk assessment |

2,3,4,5,6,7,9 |

1,8 |

|

2. Audit strategy and audit plan |

10,11,12 |

13 |

|

|

3. Interim audit vs final audit |

14,15,16 |

17 |

|

|

4. Audit documentation |

19,21 |

18,20 |

|

|

Reference: BPP ACCA F8 - Audit & Aussurance StudyText |

|||

2. Dạng bài tập chi tiết

2.1. Dạng 1: Risk assessment

Ref: Tóm tắt kiến thức Dạng 1: Risk assessment

Mức độ: Quan trọng

OTQ & OT Case

Câu 1: (3.6m) (TB)

Learning outcome:

Hiểu được tầm quan trọng của risk assessment trong planning stage

Question:

You are an audit senior of TEY & Co and are responsible for planning the audit of EuKaRe, a charity which was established over five years ago for the year ended 30 September 20X8.

Indicate which of the following statements gives a true explanation of the needs of risk assessment to be carried out at the planning stage?

|

True |

False |

|

|

The risk assessment will help the audit team gain an understanding of the entity for audit purposes |

||

|

The risk assessment will enable the audit senior to produce an accurate budget for the audit assignment |

||

|

The risk assessment will form the basis of the audit strategy and the detailed audit plan |

||

|

Once the risks have been assessed, TEY & Co can select an audit team members with sufficient skill and experience to maximise the chance of those risks being addressed |

Guidance:

It is very important that auditors carry out this risk assessment at the planning stage because (ISA 315):

- It helps the auditor gain an understanding of the entity for audit purposes

- It helps the auditor focus on the most important areas of the financial statements (where material misstatements are more likely), therefore increasing efficiency

- The risk assessment will form the basis of the audit strategy and the more detailed audit plan

- Once the risks have been assessed, audit team members of sufficient skill and experience can be allocated to maximize the chance of those risks being addressed

References:

- F8 BPP Chapter 6: Planning and risk assessment phần 4 Assessing the risks of material misstatement

- SAPP Knowledge base

Answer:

|

True |

False |

|

|

The risk assessment will help the audit team gain an understanding of the entity for audit purposes |

||

|

The risk assessment will enable the audit senior to produce an accurate budget for the audit assignment |

||

|

The risk assessment will form the basis of the audit strategy and the detailed audit plan |

||

|

Once the risks have been assessed, TEY & Co can select an audit team members with sufficient skill and experience to maximize the chance of those risks being addressed |

Statement (1), (3), and (4) is true base on the guidance above

Whilst an audit firm is a commercial and profit-making organization, ISA 315 is not concerned with the auditor's budget but rather with ensuring that the auditor has a sufficient understanding of the business. → Statement (2) is false

Câu 2-6: (Trung bình)

You are planning the audit of Veryan Co for the year ending 31 July 20X5. Veryan Co is a new audit client which operates in the oil & gas exploration industry. Companies wishing to operate in this industry require a license that is valid for 20 years. Licensing authorities take into account public health and safety, protection of the environment, and protection of biological resources when granting licenses. Veryan Co’s activities are geographically spread across three continents in 35 locations.

Veryan Co has been in existence for 30 years and has grown its revenue at an average of 12% per annum. This is in line with the industry average. During your planning meeting with the finance director, you were informed that the forecast profit before tax for this financial year is $9.5 million (20X4: $6 million) based on revenues of $124 million (20X4: $100 million).

You have completed the audit strategy and the risk assessment section identifies the following as areas of significant risk of material misstatement:

- Overstatement of receivables due to long outstanding debts

- Misstatement of intangible assets (licenses) due to incorrect amortization

- Overstatement of non‐current assets due to impairment of exploration areas that have been decommissioned

- Overstatement of inventory due to the inherent difficulty of establishing the quantity of oil and gas reserves

Câu 2:

Question

Which of the following is the LEAST significant audit risk to be considered when planning the audit of Veryan Co?

A. Non‐compliance with laws and regulationsB. Understatement of trade payables

C. Adequacy of provisions and contingent liabilities

D. Foreign currency transactions

Answer: B

Guidance:

Significant audit risk is a risk that more likely leads to a material misstatement in financial statements. There is no specific way to determine significant audit risk, it bases on the client’s industry and the judgment of the auditor.

Example: Client is an oil & gas exploration company. To ensure the safety of employees, the company has to comply with occupational safety regulations so non-compliance with laws and regulations is a significant audit risk.

To answer this type of question, you should determine which statement describe certainly a significant audit risk and the remaining statement will be the LEAST one.

References:

- F8 BPP Chapter 6: Risk assessment phần 4.2: Significant risk

- SAPP Knowledge base

Answer: B

Oil and gas companies are heavily regulated → Option A is a significant audit risk.

Provisions and contingent liabilities may arise if there are issues such as oil spills or injury to employees in the workplace given the hazardous nature of the industry → Option C is a significant audit risk.

The company operates in three continents → Option D is a significant audit risk

Trade payables may be a risk for certain clients but in relation to the other risks stated, is unlikely to be a significant risk → Option B is true

Câu 3:

Question:

Which TWO of the following are appropriate responses to address the increased detection risk due to Veryan Co being a new audit client?

A. Extended controls testing should be performedB. Obtain an understanding of Veryan Co

C. Consideration should be given to relying on the work of an independent expert

D. Reduce reliance on tests of controls

E. Contact the previous auditor to request working papers

Guidance:

Responding to the audit risk including overall response, a test of controls, and substantive procedures. There is no specific way to determine appropriate responses, it bases on your judgment.

To answer this type of question, you need to understand the definition of overall response, a test of controls, and substantive procedures and procedures auditors can choose when using each of these responses. Read as many cases as possible and you will be more familiar with risk response.

References:

- F8 BPP Chapter 6: Risk assessment phần 5: Responding to the risk assessment

- SAPP Knowledge base

Answer: B + E

Detection risk is greater due to the lack of knowledge and experience of the client. In order to address this, the auditor must spend time obtaining an understanding of the client. The auditor can request copies of working papers from the previous auditor to help with this → Option B and E are appropriate responses.

Veryan Co is a new client so they do not have any information about their internal control and their industry. Because of that, they must understand the company before deciding they should extended controls testing, reduce reliance on tests of controls, and using work of independent experts or not → Option A, C, D are inappropriate responses.

Câu 4:

Question:

Which of the following is the LEAST appropriate materiality level to be used in the audit of Veryan Co?

A. $1.5 millionB. $1.0 million

C. $750,000

D. $475,000

Guidance:

Common benchmark to identify materiality level

|

Value |

% |

|

Profit before tax |

5 |

|

Gross profit |

½–1 |

|

Revenue |

½–1 |

|

Total assets |

1–2 |

|

Net assets |

2–5 |

|

Profit after tax |

5–10 |

References:

- F8 BPP Chapter 6: Risk assessment phần 2.1: Determining and calculating materiality and performance materiality when planning the audit

- SAPP Knowledge base

Answer: A

Materiality ranges using traditional benchmarks:

Revenue (½% – 1%) $620,000 – $1,240,000

Profit before tax (5% – 10%) $475,000 – $950,000

As Veryan Co is a new audit client it is likely that materiality will be set at the lower end of the materiality scale to reflect the increased detection risk.

Option A is 16% of profit and 1.2% of revenue and is therefore too high based on the traditional benchmark calculations.

Options B, C, and D all sit within the ranges calculated above.

Câu 5:

Question:

Select whether the following statements are consistent or not consistent with the movement in revenue.

|

Cut‐off of revenue is an audit risk |

Consistent |

Not consistent |

|

Completeness of revenue is an audit risk |

Consistent |

Not consistent |

|

The occurrence of revenue is an audit risk |

Consistent |

Not consistent |

Guidance:

Overstate revenue can come from:

- Occurrence of revenue: sales have not occurred and are fictitious

- Accuracy: Calculate revenue wrongly

- Cut-off: sales relating to next year have been included in this year

References:

- F8 BPP Chapter 6: Risk assessment phần 1.4: Overall audit risk và Chapter 8: Introduction to audit evidence phần 2 Financial statement assertions

- SAPP Knowledge base chương 6 và chương 8

Answer:

|

Cut‐off of revenue is an audit risk |

Consistent |

|

|

Completeness of revenue is an audit risk |

|

Not consistent |

|

Occurrence of revenue is an audit risk |

Consistent |

Revenue has increased by 24% ($124 million/$100 million) compared with 12% in previous years.

→ Revenue may be overstated due to cut‐off errors where sales relating to next year have been included in this year and may be overstated if sales have not occurred and are fictitious.

→ Statement (1) and (3) are consistent

Completeness would be a risk if revenue was lower than expected, however, as the profit margin has increased from 6% (6/100 × 100) to 7.7% (9.5/124 × 100) revenue appears to be overstated rather than understated.

→ Statement (2) is not consistent

Câu 6:

Question

Match the audit risks given with the MOST appropriate response the auditor of Veryan Co should take.

|

Audit risk |

Auditor’s response |

|

| 1. Receivables | A. Physically inspect a sample of exploration areas | |

| 2. Non-current assets | B. Contact a sample of customers to confirm the year‐end balance | |

| 3. Intangible assets (licenses) | C. Ask management to adjust the financial statements | |

| D. Inspect the license agreement | ||

| E. Review correspondence with customers | ||

| F. Calculate the expected amortization | ||

| G. Review the depreciation charge for the adequacy |

Guidance:

Tương tự câu 3 Dạng 1: Risk assessment

Answer: 1E, 2F, 3G

|

Receivables |

To assess the recoverability of receivables, reviewing correspondence with customers may highlight any disputes which indicate that payment will not be made. → Option E is appropriate (Direct confirmation of a customer balance confirms the existence of the debt but does not provide evidence that it will be paid => Option B is not appropriate) |

|

Non‐current assets |

Impairment of non‐current assets would necessitate an increased depreciation charge. Reviewing the depreciation charge for adequacy would enable the auditor to assess whether an impairment charge has been made. → Option F is appropriate. (Inspection of the exploration sites is not a practical or effective audit procedure => Option A is not appropriate) |

|

Intangible assets (licenses) |

Amortisation of intangible assets can be checked by calculating the expected amortization charge and comparing it with management’s figure. → Option G is appropriate. (Inspecting the license agreement will only confirm the terms of the license but will not state the amortization charge that should be made each year => Option D is not appropriate) |

Câu 7:

Question:

Which of the following correctly describes the term performance materiality?

A. An amount that, through its omission or misstatement, would affect the economic decisions of the users taken on the basis of the financial statementsB. The maximum amount of misstatement the auditor is willing to accept and still conclude that the financial statements are fairly stated

C. An amount that reduces the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole

D. An amount below which misstatements of balances and classes of transactions in the financial statements would be clearly trivial

Guidance:

References:

- F8 BPP Chapter 6: Risk assessment phần 2.1: Determining and calculating materiality and performance materiality when planning the audit

- SAPP Knowledge base

Answer: C

Option 1 describes materiality.

Option 2 describes tolerable misstatement.

Option 4 describes a clearly trivial threshold.

Câu 8: (9m) (Dễ) (Đọc thêm)

Learning outcome:

Hiểu được concept của materiality và performance materiality

Question:

Explain the concepts of materiality and performance materiality in accordance with ISA 320 Materiality in Planning and Performing an Audit.

Answer:

Materiality is defined in ISA 320 as follows:

‘Misstatements, including omissions, are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.’

In assessing the level of materiality, there are a number of areas that should be considered.

- The quantity of the misstatement: Refers to the relative size of it and the quality refers to an amount that might be low in value but due to its prominence could influence the user’s decision, for example, directors’ transactions.

As per ISA 320, materiality is often calculated using benchmarks such as 5% of profit before tax or 1% of total revenue or total expenses. These values are useful as a starting point for assessing materiality.

- Nature (quality) of any misstatements: Ultimately a matter of the auditor’s professional judgment, and it is affected by the auditor’s perception of the financial information needs of users of the financial statements and the perceived level of risk; the higher the risk, the lower the level of overall materiality.

- The auditor must also consider that a number of errors each with a low value may, when aggregated, amount to a material misstatement.

In calculating materiality, the auditor should also set the performance materiality level.

Performance materiality is normally set at a level lower than overall materiality. It is used for testing individual transactions, account balances, and disclosures. The aim of performance materiality is to reduce the risk that the total of errors in balances, transactions, and disclosures does not in total exceed overall materiality.

References:

- F8 BPP Chapter 6: Risk assessment phần 2 Materiality

- SAPP Knowledge base

Câu 9: (9m) (Trung bình) (Đọc thêm)

Learning outcome:

Hiểu được các nguồn thông tin mà auditor có thể sử dụng để lấy thông tin về doanh nghiệp và các thông tin mà auditor lấy được từ các nguồn này.

Question:

List FIVE sources of information that would be of use in gaining an understanding of a company, and for each source describe what you would expect to obtain.

Answer:

|

Information source |

Expect to obtain |

|

Permanent audit file |

Information on matters of continuing importance for the company and the audit team, such as governing documents, share certificates, and ongoing contractual agreements. |

|

Prior year audit file |

An awareness of issues arising in the prior year audit and the implications for the current year audit, especially the risk assessment where issues in the prior year suggest a particular area is more susceptible to misstatements. |

|

Prior year financial statements |

Information on the historic performance of the entity |

|

Systems notes/Internal control questionnaires |

Information on how each of the key accounting systems is designed, how it operates and how robust the internal controls are. |

|

Company website |

Information on recent developments or press activity |

|

Financial statements or financial information relating |

Information from which the auditor can develop expectations when undertaking preliminary analytical |

|

Company budgets |

A reference point for expected performance can be compared with actual performance. |

|

Prior year report to management |

Information on deficiencies identified last year and auditor recommendations. If the deficiencies are unresolved this will impact the risk assessment |

|

Discussions with management |

Information in relation to any important issues arising or changes to the company during the period under review. |

References: F8 Kaplan Chapter 5: Risk phần 3 Risk assessment procedures

2.2. Dạng 2: Audit strategy and audit plan

Ref: Tóm tắt kiến thức Dạng 2: Audit strategy and audit plan

Mức độ: Ít quan trọng

OTQ & OT case

Câu 10: (3.6m) (Dễ)

Learning outcome: Hiểu được mục tiêu của planning the audit

Question:

What are the purposes of planning the audit?

(1) To ensure appropriate attention is devoted to different areas of the audit(2) To identify potential problem areas

(3) To facilitate delegation of work to audit team members

(4) To ensure the audit is completed within budget and time restraints

A. (1), (2), (3), and (4)

B. (1), (3), and (4)

C. (1), (2), and (3)

D. (2) and (3)

Guidance:

Audits are planned to:

- Help the auditor devote appropriate attention to important areas of the audit

- Help the auditor identify and resolve potential problems on a timely basis

- Help the auditor properly organize and manage the audit so it is performed in an effective manner

- Assist in the selection of appropriate team members and assignment of work to them

- Facilitate the direction, supervision, and review of work

- Assist in coordination of work done by auditors of components and experts

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.1 The importance of planning

- SAPP Knowledge base

Answer: C

Statement (1), (2), (3) are purposes of planning the audit.

Câu 11: (3.6m) (Dễ)

Learning outcome: Phân biệt 1 tài liệu được đưa vào audit strategy hay audit plan

Question:

Indicate whether each area below would be included in the audit strategy document or in the detailed audit plan

|

|

Area |

Audit strategy document |

Detailed audit plan |

||

|

(1) |

The availability of the client's data and staff (including internal audit) |

|

|

||

|

(2) |

The allocation of responsibility for specific audit procedures to audit team members |

|

|

||

|

(3) |

The audit procedures to be undertaken for each area of the financial statements |

|

|

||

|

(4) |

The assignment of work to team members |

|

|

||

|

(5) |

Areas identified with higher risk of material misstatement |

|

|

Guidance:

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.2 The overall audit strategy and the audit plan

- SAPP Knowledge base

Answer:

|

|

Area |

Audit strategy document |

Detailed audit plan |

||

|

(1) |

The availability of the client's data and staff (including internal audit) |

|

|

||

|

(2) |

The allocation of responsibility for specific audit procedures to audit team members |

|

|

||

|

(3) |

The audit procedures to be undertaken for each area of the financial statements |

|

|

||

|

(4) |

The assignment of work to team members |

|

|

||

|

(5) |

Areas identified with higher risk of material misstatement |

|

|

Area (1) refers to characteristics of the engagement → included in the audit strategy document

Area (2) refers to the nature, timing, and extent of further audit procedures → included in the detailed audit plan

Câu 12: (3.6m) (Dễ)

Learning outcome: Phân biệt audit strategy và audit plan

Question:

Which of the following statements are correct about audit strategy and audit plan?

- The audit plan should be developed before the audit strategy is established.

- The audit strategy should determine what procedures should be carried out and who should do them

- The overall audit strategy should be more detailed than the audit plan.

- The audit strategy should be established before the audit plan is developed.

A. (3) and (4)

B. (2) only

C. (4) only

D. (1) and (3)

Answer: A

The Audit plan should be established after the audit strategy and more detail than the audit strategy → Statement (3) and (4) is true, statement (1) is false.

The audit plan determine what procedures should be carried out and who should do them instead of audit strategy → Statement (2) is false

References:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.2 The overall audit strategy and the audit plan

- SAPP Knowledge base

Câu 13: CRQ Case:

You are an audit supervisor of Cupid & Co, planning the final audit of a new client, Prancer Construction Co, for the year ending 30 September 20X7. The company specializes in property construction and providing ongoing annual maintenance services for properties previously constructed. Forecast profit before tax is $13·8m and total assets are expected to be $22·3m, both of which are higher than for the year ended 30 September 20X6.

You are required to produce the audit strategy document. The audit manager has met with Prancer Construction Co’s finance director and has provided you with the following notes, a copy of the August management accounts, and the prior year's financial statements.

Meeting notes

The prior year's financial statements recognize work in progress of $1·8m, which was comprised of property construction in progress as well as ongoing maintenance services for finished properties. The August 20X7 management accounts recognize a $2·1m inventory of completed properties compared to a balance of $1·4m in September 20X6. A full year-end inventory count will be undertaken on 30 September at all of the 11 building sites where construction is in progress. There is not sufficient audit team resource to attend to all inventory counts.

In line with industry practice, Prancer Construction Co offers its customers a five-year building warranty, which covers any construction defects. Customers are not required to pay any additional fees to obtain the warranty. The finance director anticipates this provision will be lower than last year as the company has improved its building practices and therefore the quality of the finished properties.

Customers who wish to purchase a property are required to place an order and pay a 5% non-refundable deposit prior to the completion of the building. When the building is complete, customers pay a further 92·5%, with the final 2·5% due to being paid six months later. The finance director has informed you that although an allowance for receivables has historically been maintained, it is anticipated that this can be significantly reduced.

Information from management accounts

Prancer Construction Co’s prior year financial statements and August 20X7 management accounts contain a material overdraft balance. The finance director has confirmed that there are minimum profit and net assets covenants attached to the overdraft.

A review of the management accounts shows the payables period was 56 days for August 20X7, compared to 87 days for September 20X6. The finance director anticipates that the September 20X7 payables days will be even lower than those in August 20X7.

Required:

Identify THREE main areas, other than audit risks, which should be included within the audit strategy document for Prancer Construction Co, and for each area provide an example relevant to the audit.

Guidance:

Step 1: Choose 3 out of 4 main areas that the auditor may consider when establishing an overall audit strategy

- Characteristics of the engagement;

- Reporting objectives, the timing of the audit, and nature of communications;

- Significant factors, preliminary engagement activities, and knowledge gained on other engagements;

- Nature, timing, and extent of resources.

Step 2: With each main area, choose a specific matter to design an example, normally a simple sentence. Remember to use information from the case given to generate a specific answer.

You can choose a specific matter from the following matter (Reference: F8 BPP Chapter 7: Audit planning and documentation phần 1.2.1 The audit strategy)

Example: In this scenario, by using “financial reporting framework” from “characteristics of the engagement” area, we can create an example:

“

Note: Simple answers like “Financial reporting framework” or answers that not replace by the scenario won’t give you any mark.

Answer:

Main characteristics of the engagement

The audit strategy should consider the main characteristics of the engagement, which define its scope. For Prancer Construction Co, the following are examples of things that should be included:

- Whether the financial information to be audited has been prepared in accordance with the relevant financial reporting framework.

- Whether computer-assisted audit techniques will be used and the effect of IT on audit procedures.

- The availability of key personnel at Prancer Construction Co.

Reporting objectives, timing, and nature of communication

It should ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature of the communications required, such as:

- The audit timetable for reporting including the timing of interim and final stages;

- Organisation of meetings with Prancer Construction Co’s management to discuss any audit issues arising;

- Any discussions with management regarding the reports to be issued;

- The timings of the audit team meetings and review of work performed.

Significant factors affecting the audit

The strategy should consider the factors which, in the auditor’s professional judgment, are significant in directing Prancer Construction Co’s audit team’s efforts, such as:

- The determination of materiality for the audit.

- The need to maintain a questioning mind and to exercise professional skepticism in gathering and evaluating audit evidence.

Preliminary engagement activities and knowledge from previous engagements

It should consider the results of preliminary audit planning activities and, where applicable, whether knowledge gained on other engagements for Prancer Construction Co is relevant, such as:

- Results of any tests over the effectiveness of internal controls.

- Evidence of management’s commitment to the design, implementation and maintenance of sound internal controls.

- The volume of transactions, which may determine whether it is more efficient for the audit team to rely on internal controls.

- Significant business developments affecting Prancer Construction Co, such as the improvement in building practices and construction quality.

Nature, timing, and extent of resources

The audit strategy should ascertain the nature, timing, and extent of resources necessary to perform the audit, such as:

- The selection of the audit team with experience in this type of industry.

- Assignment of audit work to the team members.

- Setting the audit budget.

2.3. Dạng 3: Interim audit vs final audit

Mức độ: Ít quan trọng

OTQ & OT case:

Câu 14: (3.6m) (Trung bình)

Learning outcome: Xác định procedures thuộc interim audit hay final audit

Which of the following statements, if any, is/are correct?

- Carrying out tests of control on the company’s sales day books would normally be undertaken during an interim audit.

- Review of aged receivables ledger to identify balances requiring to write down or allowance would normally be undertaken during a final audit.

A. Neither 1 nor 2

B. Both 1 and 2

C. 1 only

D. 2 only

Guidance:

→ You should classify procedures performed to risk assessment and documenting and testing internal control to interim audit and procedures performed to test transactions, balances to final audit.

To be more specific, work performed in interim audit and final audit is

|

Interim audit |

Final audit |

|

|

Work performed |

|

|

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.3.1 The purpose of the interim audit and procedures likely to be adopted

- SAPP Knowledge base

Answer: B

Statement (1) is a procedure performed to evaluate the sale cycle so it should be undertaken during interim audit → Statement (1) is true.

Statement (2) is a procedure performed to test receivables and allowance balance so it should be undertaken during the final audit → Statement (2) is true.

Câu 15: (3.6m) (Trung bình)

Question:

Which of the following distinguishes between an interim audit and a final audit?

A. Interim: performed by the auditor appointed until the next annual general meeting (AGM); Final: performed by the auditor appointed at the AGMB. Interim: A review process that is less than a full audit; Final: A full audit

C. Interim: performed by the internal audit; Final: performed by the external audit

D. Interim: performed through the year; Final: performed after the year-end

Answer: D

The interim audit is performed during the year to assist in identifying significant matters at an early stage and reduces the time taken at the final audit, which performs after the year-end.

Interim audit and final audit are 2 stages of an audit so they are performed by the same audit firm → Option A is false

Interim audit is a process that focuses on risk assessment and documenting and testing internal controls to reduce works in the final audit, not a review process → Option B is false

Interim audit and final audit are both performed by external audit → Option C is false

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 3 Interim and final audits

- SAPP Knowledge base

Câu 16: (3.6m) (Dễ)

Question:

You are an audit senior of UYE & Co and your firm is the external auditor of Carlise Co. During the interim audit, you performed internal controls testing and the results of these indicate that, to date, the control environment is strong and internal controls are operating effectively.

Carlise Co’s director has asked you to explain the factors that will determine the extent of further work on internal controls that will need to be performed at the final audit.

Which of the following should be taken into account when determining the extent of the additional work needed at the final audit?

- The significance of the assessed risks of material misstatement at the assertion level

- The specific controls that were tested during the interim period, and significant changes to them since they were tested, including changes in the information system, processes, and personnel

- The length of the remaining period

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Answer: D

Factor should be taken into account when determining the extent of the additional work needed at the final audit:

- The significance of the assessed risks of material misstatement at the assertion level (Statement (1))

- The specific controls that were tested during the interim period, and significant changes to them since they were tested, including changes in the information system, processes and personnel (Statement (2))

- The degree to which audit evidence about the operating effectiveness of those controls was obtained

- The length of the remaining period (Statement (3))

- The extent to which the auditor intends to reduce further substantive procedures based on the reliance on controls

- The control environment

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.3.3 Impact of interim audit work relating to internal controls on the final audit

- SAPP Knowledge base

Câu 17: (12.6m) (Trung bình)

Question:

Milla Cola Co (Milla) manufactures fizzy drinks such as cola and lemonade as well as other soft drinks and its year-end is 30 September 20X5. You are an audit manager of Totti & Co and are currently planning the audit of Milla. You attended the planning meeting with the audit engagement partner and finance director last week and the minutes from the meeting are shown below. You are reviewing these as part of the process of preparing the audit strategy document.

Minutes of the planning meeting for Milla

Milla’s trading results have been strong this year and the company is forecasting revenue of $85 million, which is an increase from the previous year. The company has invested significantly in the cola and fizzy drinks production process at the factory. This resulted in an expenditure of $5 million on updating, repairing, and replacing a significant amount of the machinery used in the production process.

As the level of production has increased, the company has expanded the number of warehouses it uses to store inventory. It now utilizes 15 warehouses; some are owned by Milla and some are rented from third parties. There will be inventory counts taking place at all 15 of these sites at the year-end.

A new accounting general ledger has been introduced at the beginning of the year, with the old and new systems being run in parallel for a period of two months. In addition, Milla has incurred an expenditure of $4·5 million on developing a new brand of fizzy soft drinks. The company started this process in July 20X4 and is close to launching its new product into the marketplace.

As a result of the increase in revenue, Milla has recently recruited a new credit controller to chase outstanding receivables. The finance director thinks it is not necessary to continue to maintain an allowance for receivables and so has released the opening allowance of $1·5 million.

The finance director stated that there was a problem in April in the mixing of raw materials within the production process which resulted in a large batch of cola products tasting different. A number of these products were sold; however, due to complaints by customers about the flavor, no further sales of these goods have been made. No adjustment has been made to the valuation of the damaged inventory, which will still be held at a cost of $1 million at the year-end.

As in previous years, the management of Milla is due to be paid a significant annual bonus based on the value of year-end total assets.

The finance director has requested that the deadline for the 20X6 audit be shortened by a month and has asked the audit engagement partner to consider if this will be possible. The partner has suggested that in order to meet this new tighter deadline the firm may carry out both an interim and final audit for the audit of Milla to 30 September 20X6.

Required:

- Explain the difference between an interim and a final audit.

- Explain the procedures which are likely to be performed during an interim audit of Milla and the impact which it would have on the final audit.

Guidance:

- Explain the difference between an interim and a final audit.

- Explain the procedures which are likely to be performed during an interim audit

When designing procedures performed during an interim audit, you can base on some procedures like:

- Inherent risk assessment and gaining an understanding of the entity

- Recording the entity's system of internal control

- Evaluating the design of internal controls

- Carrying out tests of control on the company's internal controls

- Performing substantive testing of transactions/balances to gain evidence that the books and records are a reliable basis for the preparation of financial statements

- Identification of issues that may have an impact on work to take place at the final audit

But you have to relate to the scenario. For example “Carrying out tests of control on the company's internal controls” won’t give you any mark. You have to give a specific answer like “Undertake tests of controls on Milla’s key transaction cycles of sales, purchases and inventory, and credit control.”

Another good way to design procedures is try to look for any new events or any significant differences which can raise risks or you need to obtain understanding

Example: “A new accounting general ledger has been introduced at the beginning of the year” is a new event which can lead to risk of documenting wrongly or inaccurately so you can use procedures to evaluate this risk e.g. “Review and updating of the documentation of accounting systems at Milla”

- Impact of interim audit on final audit

|

General |

|

|

Interim audit work relating to internal controls |

Change level of the substantive testing base on evidence about control of the client |

|

Interim audit work relating to substantive procedures |

Reduce works because they have to test period from the interim audit to the year-end only |

References:

- F8 BPP Chapter 7: Audit planning and documentation phần 1.3 Interim and final audit

- SAPP Knowledge base

Answer:

1. Differences between an interim and a final auditInterim audit

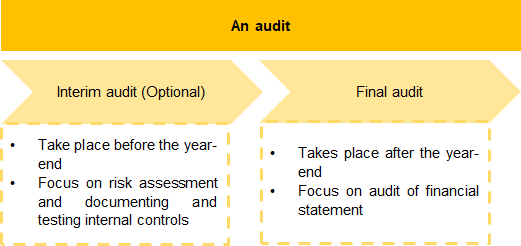

The interim audit is that part of the audit that takes place before the year-end. In an interim audit, auditors usually focus on risk assessment and documenting and testing internal controls.

There is no requirement to undertake an interim audit; factors to consider when deciding upon whether to have one include the size and complexity of the company along with the effectiveness of internal controls.

Final audit

The final audit will take place after the year-end and concludes with the auditor forming and expressing an opinion on the financial statements for the whole year subject to audit.

It is important to note that the final opinion takes account of conclusions formed at both the interim and final audits.

2. Procedures that could be undertaken during the interim audit include:- Review and updating of the documentation of accounting systems at Milla (Refer to event from scenario “A new accounting general ledger has been introduced at the beginning of the year”

- Discussions with management on the recent growth and any other changes within the business which have occurred during the year to date at Milla to update the auditor’s understanding of the company (Refer to procedure (1))

- Assessment of risks that will impact the final audit of Milla (Refer to procedure (6))

- Undertake tests of controls on Milla’s key transaction cycles of sales, purchases and inventory, and credit control (Refer to procedure (4))

- Perform substantive procedures on profit and loss transactions for the year to date and any other completed material transactions (Refer to procedure (5) and event from scenario “mixing of raw materials within the production process”)

Impact of interim audit on the final audit

- As some testing has already been undertaken, there will be less work to be performed at the final audit, which may result in a shorter audit and audited financial statements possibly being available earlier.

- The outcome of the controls testing undertaken during the interim audit will impact the level of substantive testing to be undertaken.

- If the controls tested have proven to be operating effectively, then the auditor may be able to reduce the level of detailed substantive testing required as they will be able to place reliance on the controls.

- In addition, if substantive procedures were undertaken at the interim audit, then only the period from the interim audit to the year-end will require to be tested.

2.4. Dạng 4: Audit documentation

Ref: Tóm tắt kiến thức Dạng 4: Audit documentation

Mức độ: Ít quan trọng

OTQ & OT Case

Câu 18: (7.2m) (Dễ)

Question:

Describe the FOUR benefits of documenting audit work.

Answer: Audit documentation

- Provides evidence of the auditor’s basis for a conclusion about the achievement of the overall objective of the audit.

- Provides evidence that the audit was planned and performed in accordance with ISAs and applicable legal and regulatory requirements.

- Assists the engagement team to plan and perform the audit.

- Assists members of the engagement team responsible for supervision to direct, supervise and review the audit work.

- Enables the engagement team to be accountable for its work.

- Retains a record of matters of continuing significance to future audits.

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 1 The objective of audit documentation

- SAPP Knowledge base

Câu 19: (3.6m) (Dễ)

Question:

Which statement is true about the audit working paper?

- The form and content of working papers are affected by matters such as the cost of the audit and the significance of the audit evidence obtained

- Working papers are the property of both clients and the auditors and they are kept by the auditors

- ACCA recommends that working papers should be retained for a minimum period of five years.

- Auditors can meet their overall audit objectives and support their audit opinion without documenting their work.

A. (1) and (3)

B. (1), (2), and (4)

C. (3) and (4)

D. (3) only

Answer: D

ISA 230 requires a period of no less than five years from the date of the auditor's report (ISA 230: para. A23) → Statement (3) is true

The form and content of the audit working paper aren’t affected by the cost of the audited → Statement (1) is false

Working papers are property of the auditors → Statement (2) is false

Obtaining sufficient appropriate audit evidence is necessary to reduce audit risk to an acceptably low level and thereby enable the auditor to draw reasonable conclusions on which to base an opinion. → Statement 4 is false

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 2 Audit documentation

- SAPP Knowledge base

Câu 20: (7.2m) (Dễ)

Question:

List and explain the purpose of FOUR items that should be included on every working paper prepared by the audit team.

Answer: Working papers

- Name of the client – identifies the client being audited.

- Year-end date – identifies the year-end to which the audit working papers relate.

- Subject – identifies the area of the financial statements that are being audited, the topic area of the working paper, such as receivables circularisation.

- Working paper reference – provides a clear reference to identify the number of the working paper, for example, R12 being the 12th working paper in the audit of receivables.

- Preparer – identifies the name of the audit team member who prepared the working paper, so any queries can be directed to the relevant person.

- Date prepared – the date that the audit work was performed by the team member; this helps to identify what was known at the time and what issues may have occurred subsequently.

- Reviewer – the name of the audit team member who reviewed the working paper; this provides evidence that the audit work was reviewed by an appropriate member of the team.

- Date of review – the date the audit work was reviewed by the senior member of the team; this should be prior to the date that the audit report was signed.

- The objective of work/test – the aim of the work being performed, could be the related financial statement assertion; this provides the context for why the audit procedure is being performed.

- Details of work performed – the audit tests performed along with sufficient detail of items selected for testing.

- Results of work performed – whether any exceptions arose in the audit work and if any further work is required.

- Conclusion – The overall conclusion on the audit work performed, whether the area is true and fair.

Reference:

- F8 BPP Chapter 7: Audit planning and documentation phần 2.1 Examples of working papers

- SAPP Knowledge base

- Link 1 working paper thực tế:

Câu 21: (3.6m) (Dễ)

Question:

Complete the table, using the working papers given below:

|

Current audit files |

Permanent audit files |

|

Engagement letters |

Financial statements |

|

Notes of board minutes |

Board minutes of continuing relevance |

|

Written representations |

Previous years' signed accounts, analytical review and reports to management |

|

Details of the history of the client's business |

A summary of unadjusted errors |

Guidance:

|

Permanent audit files (containing information of continuing importance to the audit) |

Current audit files (containing information of relevance to the current year's audit) |

|

· Engagement letters. · New client questionnaire. · The memorandum and articles. · Other legal documents such as prospectuses, leases, sales agreements. · Details of the history of the client's business. · Board minutes of continuing relevance · Previous years' signed accounts, analytical review and reports to management. · Accounting systems notes, previous years' control questionnaires. |

· Financial statements. · Accounts checklists. · Management accounts details. · Reconciliations of management and financial accounts. · A summary of unadjusted errors. · Report to partner including details of significant events and errors. · Review notes. · Audit planning memorandum. · Time budgets and summaries. · Written representations. · Report to management. · Notes of board minutes. · Communications with third parties such as experts or other auditors. · Working papers covering each risk area:

⇒ Details of substantive tests and tests of control. |

Answer:

|

Current audit files |

Permanent audit files |

|

|

|

|

|

|

|

|

Reference: F8 BPP Chapter 7: Audit planning and documentation phần 2.2.2 Audit files

Author: Hong Quan