[FIA/FA2: Tài liệu ôn thi] Session 2 (Phần 1)

Session 2 (Phần 1) sẽ ôn lại 3 dạng bài tập quan trọng môn Maintaining Financial Records (FA2) với chủ đề Recording transactions and events và Preparing a trial balance and correcting errors.

I. Tổng quan

|

Topic |

Question types |

Question index |

|

|

|

MCQ |

|

Recording transactions and events (continue) |

1. Provisions and liabilities |

23 - 25 |

|

Preparing a trial balance and correcting errors |

1. Errors in the trial balance |

26 - 29 |

|

2. Correction of errors using journal entries and suspense account |

30 - 32 |

II. Dạng bài tập chi tiết

1. Topic 3: Recording transactions and events (continue)

1.1. Type 7: Provisions and liabilities

Importance: High

|

Question 23: In January 20X4, Sarah took out a bank loan of $30,000. This is to be repaid in three equal annual installments. The first installment is due for payment on 1 January 20X5. How will the outstanding balance be reported in Sarah’s statement of financial position at 30 September 20X4? A. $10,000 as a current liability and $20,000 as a non-current liability B. $20,000 as a current liability and $10,000 as a non-current liability C. $30,000 as a current liability D. $30,000 as a non-current liability |

Guidance:

Remind of the main difference between a current liability and a non-current liability:

- Current liability – an item that is due to be paid within 1 year

- Non-current liability – an item that is due to be paid after more than 1 year

In this question, there are 3 annual installments. Students should determine how many installments are due to be paid within 1 year, how many of those are due to be paid more than 1 year. Therefore, figure out the amount of current & non-current liability.

Answer: A

Each annual installment = $30,000/3 = $10,000

On 30 September 20X4, there is only the first installment which is due 3 months from 30 September 20X4 (within 1 year) à only $10,000 is recorded as a current liability

The remaining $20,000 is due to paid for over 1 year à $20,000 is recorded as a non-current liability.

|

Question 24: Tom manufactures scaffolding and ladders. In July 20X5 he received a letter from a lawyer representing a customer who claims that he has been seriously injured while using faulty scaffolding supplied by Tom’s business. Tom has offered to pay $1,000 immediately but the customer has started legal proceedings and is claiming damages of $10,000. The court case is unlikely to take place before June 20X6. Tom’s lawyer has advised that the claim is almost certain to succeed and that he will probably be required to pay $15,000. What amount should be provided for in respect of the claim in Tom’s accounts for the year ended 31 December 20X5? A. $nil B. $4,000 C. $10,000 D. $15,000 |

Guidance:

Tom should include the best estimate of the amount Tom will probably have to payout

Answer: D

|

Question 25: Wanda Co allows customers to return faulty goods within 14 days of purchase. On 30 November 20X5, a provision of $6,548 was made for sales returns. On 30 November 20X6, the provision was re-calculated and should now be $7,634. What should be reported in Wanda Co's statement of profit or loss for the year to 31 October 20X6 in respect of the provision? A. A charge of $7,634 B. A credit of $7,634 C. A charge of $1,086 D. A credit of $1,086 |

Guidance:

Remember the accounting treatment when increase or decrease the provisional amount.

|

An increase in the provision will result in an additional charge to the statement of profit or loss |

Debit Expense Credit Provision |

|

A decrease in the provision will result in a credit to the statement of profit or loss |

Debit Provision Credit Expense |

Answer: C

The provision should be increased by $1,086 (from $6,548 to $7,634), therefore an additional charge of $1,086 should be recorded in the statement of profit or loss.

2. Topic 4: Preparing a trial balance and correcting errors

2.1. Type 1: Errors in the trial balance

Ref: Tóm tắt kiến thức Type 1: Errors in the trial balance

Importance: High

|

Question 26: Bert has extracted the following list of balances from his general ledger at 31 October 20X5:

What is the total of the debit balances in Bert's trial balance at 31 October 20X5? A. $267,049 B. $275,282 C. $283,148 D. $284,931 |

Guidance:

Remind of the accounts which have a debit balance (i.e., Assets, Expenses, Contra account of Liabilities, Withdrawal, …)

Tip to recheck after calculation: Sum up all the balance then divide by 2. If the result agrees with your answer, it would be probably right. If not, it is certainly incorrect.

Answer: D

|

|

$ |

|

Opening inventory |

9,649 |

|

Purchases |

142,958 |

|

Expenses |

34,835 |

|

Non-current assets (NBV) |

63,960 |

|

Receivables |

31,746 |

|

Cash at bank |

1,783 |

|

|

––––––– |

|

|

284,931 |

Recheck:

Total balances = 258,542 + 9,649 +142,958 + 34,835 + 63,960 + 31,746 + 13,864 + 1,783 + 12,525

Total balances = 569,862

Then divide it by 2: 569,862/2 = 284,931

|

Question 27: Which one of the following is an error of principle? A. Plant and machinery purchased were credited to a non-current assets account. B. Plant and machinery purchased was debited to the purchases account. C. Plant and machinery purchased was debited to the equipment account. D. Plant and machinery purchased were credited to the equipment account. |

Guidance:

Remember: an error of principle is when a transaction has conceptually been recorded incorrectly, with a different type of account.

Answer: B

- Option B is correct. This has debited a non-current asset to the cost of sales which is an error of principle as it has broken the principles of accounting. That non-current asset should be capitalized.

- Option A is incorrect. This has credited rather than debited a non-current asset to the non-current asset account, which is an error of extraction as it posts the entries in the wrong column (debit or credit) in the trial balance.

- Option C is incorrect. This has debited a non-current asset to the equipment account which is an error of commission as it has recorded in the wrong account, but the same type of account.

- Option D is incorrect. This has credited a non-current asset to an equipment account which has broken the principles of accounting. That non-current asset should be debited in the non-current asset account.

|

Question 28: Which TWO of the following errors would cause the total of the debit column and the total of the credit column of a trial balance not to agree? A. A transposition error was made when entering a sales invoice into the sales day book B. A purchase of non-current assets was omitted from the accounting records C. A cheque received from a customer was credited to cash and correctly recognized in receivables D. Rent received was included in the trial balance as a debit balance |

Guidance:

Remind of the errors which cause the trial balance not to equal:

Answer: C, D

- A cheque received from a customer was credited to cash and correctly recognized in receivables – the correct entry should have been a debit to cash

- Rent received was included in the trial balance as a debit balance – rent received is a credit balance

|

Question 29: Which of the following is a valid reason for an accountant to close off the general ledger accounts and produce a trial balance? A. The trial balance produced will highlight all errors so the accountant can be sure every account balance is correct B. The trial balance contains exactly the same headings as included in the statement of profit or loss and statement of financial position making it easy to produce the final accounts C. It will enable the accountant to establish whether or not the value of all the debits is equal to the value of all the credits before proceeding with the preparation of the final accounts D. Accountants are required by law to produce a trial balance so the accountant must produce one as part of the preparation of the final accounts |

Guidance:

Remind of the purpose of the trial balance:

|

Purpose of the trial balance: It is a way of checking that transactions have been correctly recorded using double-entry during the period. If the double-entry procedures have been carefully followed, then the trial balance should show that the total of the debit balances agrees with the total of the credit balances. |

If the trial balance is not balanced, any discrepancy must be investigated and corrected.

However, a balanced trial balance does not guarantee the accuracy of the financial statements, as there are errors that make the trial balance still balanced.

|

Note:

|

Answer: C

- Option C is correct. Closing off the ledger accounts and producing a trial balance will enable the accountant to establish whether the value of all the debits is equal to the value of all the credits. → Match with the purpose of the trial balance

- Option A is incorrect. There are errors in which the trial balance is not balanced which can be identified easily just by determine whether the debits and credits agree. However, not every error can be reflected through the trial balance, as there are errors in which the trial balance is a balance that required further investigation to solve the discrepancy.

- Option B is incorrect. The statement is not relevant to the purpose of the trial balance

- Option D is incorrect. The trial balance is not required by law. Because the trial balance is only an optional way to check the balances, whether they are correct.

2.2. Type 2: Correction of errors using journal entries and suspense account

Ref: Tóm tắt kiến thức Type 2: Correction of errors using journal entries and suspense account

Importance: High

|

Question 30: The bookkeeper of Paris made the following mistakes: 1. Sales returns of $912 were credited to the purchases returns account. 2. Purchases returns of $740 were debited to the sales returns account. Which one of the following journal entries will correct the errors?

|

Guidance:

It is not necessary to correct the whole amount of the entries because the errors in the case can offset each other because they were mistakenly booked into each other’s accounts.

Therefore, we should compare the entered amount with the correct amount on each account, then make appropriate entries to correct the errors.

Answer: B

- The Sales returns account should include a debit of $912.

At the moment there is a debit of $740.

→ To correct the error, we need to debit the Sales account with $172, corresponding with a credit of $172 in the suspense account.

- The Purchases returns account should include a credit of $740.

At the moment there is a credit of $912.

→ To correct the error, we need to debit the Purchases account with $172, corresponding with a credit of $172 in the suspense account.

Therefore, the journal entries which will correct the errors are:

|

|

Dr |

Cr |

|

|

$ |

$ |

|

Sales returns |

172 |

|

|

Purchases returns |

172 |

|

|

Suspense account |

|

344 |

|

Question 31: Norma receives a cheque through the post for $8,000, payable to her business, but there is no covering letter or document to explain what the money is for. She thinks it might be a payment from a customer whose debt was written off two years ago as uncollectable. She banks the money immediately. How should she account for the transaction? A. Debit Bank $8,000, Credit Receivables $8,000 B. Debit Bank $8,000, Credit Suspense account $8,000 C. Debit Bad debts $8,000, Credit Receivables $8,000 D. Debit Suspense account $8,000, Credit Bank $8,000 |

Guidance:

When a debit or credit entry is unknown, students can equalize the trial balance by making an entry for the suspense account so that the debits and credits agree (without the corresponding entries elsewhere)

Answer: B

In the question, $8,000 first received in cheque then put into the bank is unknown what it is for.

Thus:

- $8,000 put in the bank should be recorded as a debit into a bank account.

- $8,000 credit (corresponding with the $8,000 credit above) can not be traced to any account, so it should be recorded in the suspense account until Norma knows for certain what the money was for.

|

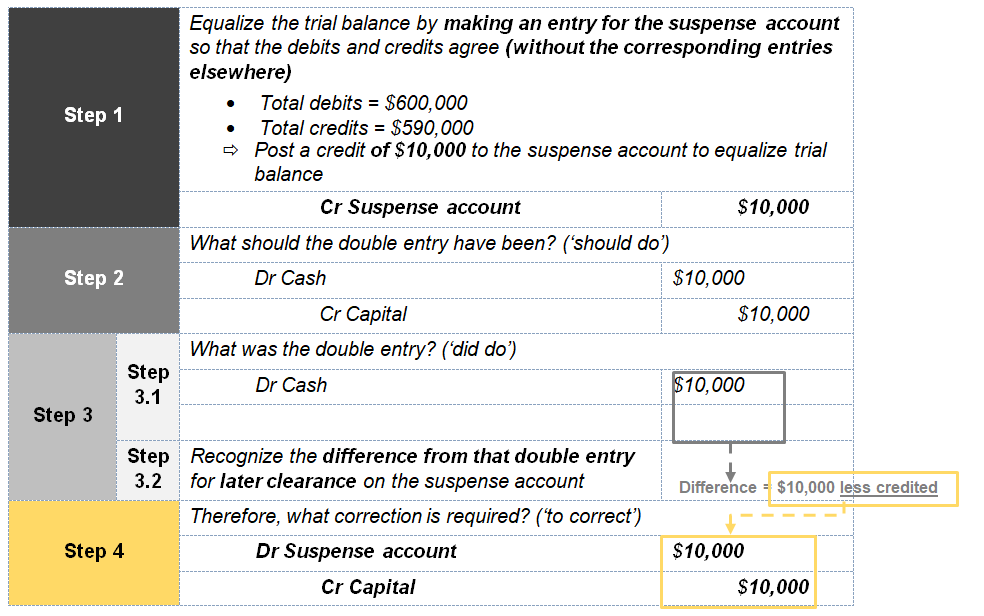

Question 32: Rhona prepared a trial balance, and found that the total of debit entries was $600,000 and the total of credit entries was $590,000. A suspense account was opened to record the difference. On investigation, she found that when she had paid $10,000 additional capital into the business earlier in the year, the transaction had been entered in the cash book, but had not been entered in any other account. What journal entry is required to eliminate the balance on the suspense account? A. Debit Suspense $10,000, Credit Capital $10,000 B. Debit Suspense $10,000, Credit Drawings $10,000 C. Debit Capital $10,000, Credit Suspense $10,000 D. Debit Drawings $10,000, Credit Suspense $10,000 |

Guidance:

When correcting errors from trial balance using suspense account, a good approach is to answer the below questions step by step:

|

Step 1 |

Equalize the trial balance by making an entry for the suspense account so that the debits and credits agree (without the corresponding entries elsewhere) |

|

|

Step 2 |

What should the double-entry have been? (‘should do’) |

|

|

Step 3 |

Step 3.1 |

What was the double-entry? (‘did do’). |

|

Step 3.2 |

Recognize the difference from that double entry for later clearance on the suspense account |

|

|

Step 4 |

Therefore, what correction is required? (‘to correct’) Clear the suspense account when the final correct entries are determined |

|

Answer: A