Session 1 (Phần 1) sẽ ôn lại 5 dạng bài tập quan trọng môn PFE (Chuẩn bị cho tuyển dụng) với chủ đề Inventory và Tangible Non-current Assets.

1.1. Type 1: Inventory valuation (Cost & NRV)

1.2. Type 2: Inventory valuation method (FIFO & AVCO)

2. Topic 2.1: Tangible Non-current Assets

2.1. Type 1: Revenue expenditure vs Capital expenditure (PPE – IAS 16)

2.2. Type 2: Depreciation, Depreciation method, Useful life, Residual Value (PPE – IAS 16)

I. Tổng quan:

|

Topic |

Question types |

Question index |

|

MCQ |

||

|

Inventory |

1. Inventory valuation (Cost & NRV) |

1 - 5 |

|

2. Inventory valuation method (FIFO & AVCO) |

6, 7 |

|

|

Tangible Non-current Assets |

1. Revenue expenditure vs Capital expenditure (PPE – IAS 16) |

8, 9 |

|

2. Depreciation, Depreciation method, Useful life, Residual Value (PPE – IAS 16) |

10, 12 |

|

|

3. Revaluation model (PPE – IAS 16) |

13, 14 |

II. Dạng bài tập chi tiết:

1. Topic 1: Inventory

1.1. Type 1: Inventory valuation (Cost & NRV)

Importance: High

|

Question 1: An item of inventory was purchased for $500. It is expected to be sold for $1,200 although $250 will need to be spent on it in order to achieve the sale. To replace the same item of inventory would cost $650. At what value should this item of inventory be included in the financial statements?

|

Guidance:

Remember: Inventory should be measured at the lower of Cost and NRV (Net Realizable Value)

- NRV = Estimated selling price – Estimated completion cost – Estimated selling cost

- Cost = Cost of purchase + Conversion cost + Other costs

Answer: $500

The inventory should be valued at a lower cost and NRV.

Cost is $500 and NRV is ($1,200 – $250) = $950. The correct valuation is therefore $500.

|

Question 2: Ajay’s annual inventory count took place on 7 July 20X6. The inventory value on this date was $38,950. During the period from 30 June 20X6 to 7 July 20X6, the following took place:

The mark-up is 25% on cost. What is Ajay’s inventory valuation on 30 June 20X6?

|

Guidance:

Remember:

- Opening Inventory + Purchases –Cost of Goods sold = Closing Inventory

- Markup on cost: Profit/Costs = (Sales – Costs)/Costs

Answer: $39,900

|

|

$ |

|

Value at 7 July 20X6 |

38,950 |

|

Sales since year-end (100/125 × $6,500) |

5,200 |

|

Purchase since year-end

Value at 30 June 20X6 |

(4,250) |

|

Question 3: Which of the following costs may be included when arriving at the cost of finished goods inventory for inclusion in the financial statements of a manufacturing company?

A. 1 and 5 only B. 2, 4, and 5 only C. 1, 3, and 5 only D. 1, 2, 3, and 5 only |

Guidance:

Remember to include all directly attributable costs of bringing the inventory available to use. The cost of inventory includes the cost of purchased merchandise, fewer discounts that are taken, plus any duties and transportation costs paid by the purchaser.

Answer: C

Carriage outwards and storage are distribution costs.

|

Question 4: The closing inventory at cost of a company at 31 January 20X3 amounted to $284,700. The following items were included at cost in the total:

What should the inventory value be according to IAS 2 Inventories after considering the above items? A. $276,400 B. $281,200 C. $282,800 D. $329,200 |

Guidance:

Remember: Inventory should be measured at the lower of Cost and NRV (Net Realizable Value)

- NRV = Estimated selling price – Estimated completion cost – Estimated selling cost

- Cost = Cost of purchase + Conversion cost + Other costs

Answer: B

|

|

Cost |

NRV |

|

Coats |

400 x $80 = $32,000 |

400 x ($75 x 95%) = $28,500 |

|

Skirts |

800 x $20 = $16,000 |

800 x ($28 - $5) - $800 = $17,600 |

|

|

$ |

|

Original value |

284,700 |

|

Coats |

|

|

Cost |

(32,000) |

|

NRV |

28,500 |

|

|

––––––– |

|

Value after revaluation |

281,200 |

|

|

––––––– |

|

Question 5: A company with an accounting date of 31 October carried out a physical check of inventory on 4 November 20X3, leading to an inventory value at cost at this date of $483,700.

What figure should appear in the company's financial statements on 31 October 20X3 for closing inventory, based on this information? A. $458,700 B. $505,900 C. $508,700 D. $461,500 |

Guidance:

In calculating yearend inventory value, using post-yearend transactions:

- Goods received should be deducted.

- Goods sold/given out should be added back.

Answer: D

|

|

$ |

|

Inventory check balance |

483,700 |

|

Less: goods from suppliers |

(38,400) |

|

Add: goods sold |

14,800 |

|

Less: goods returned |

(400) |

|

Add: goods returned to the supplier |

1,800 |

|

|

––––––– |

|

|

461,500 |

|

|

––––––– |

1.2. Type 2: Inventory valuation method (FIFO & AVCO)

Importance: Average

|

Question 6: A company has decided to switch from using the FIFO method of inventory valuation to using the average cost method (AVCO). In the first accounting period where the change is made, opening inventory valued by the FIFO method was $53,200. Closing inventory valued by the AVCO method was $59,800. Total purchases and during the period were $136,500. Using the continuous AVCO method, opening inventory would have been valued at $56,200. What is the cost of materials that should be included in the statement of profit or loss for the period? A. $129,900 B. $132,900 C. $135,900 D. $140,100 |

Guidance:

Remember:

- FIFO method: Assumes that the oldest products in a company’s inventory have been sold first. The costs paid for those oldest products are the ones used in the calculation.

- AVCO method: Values inventory at the weighted average cost of all purchases. Average cost is calculated each time inventory is issued.

Answer: B

The cost of materials used should be based on opening and closing valuations of inventory at AVCO.

|

|

$ |

|

Opening inventory |

56,200 |

|

Purchases |

136,500 |

|

|

––––––– |

|

192,700 |

|

|

Less: Closing inventory |

(59,800) |

|

|

––––––– |

|

Cost of materials used |

132,900 |

|

|

––––––– |

|

Question 7: A firm has the following transactions with its product R.

The firm uses periodic weighted average cost (AVCO) to value its inventory. What is the inventory value at the end of the year? (Give your answer to 2 decimal places)

|

Guidance:

Remember: AVCO method: Values inventory at the weighted average cost of all purchases. Average cost is calculated each time inventory is issued.

Answer: $2,057.12

Price per unit under periodic weighted average cost (AVCO):

= Total costs/(opening quantity + total quantity received)

= ($300 x 10) + ($250 x 12) + ($200 x 6)/(0 + 10 + 12 + 6)

= $257.14 per unit.

Valuation of closing inventory of 8 units = (10 + 12 – 8 + 6 – 12) x $257.14 = $2,057.12

2. Topic 2.1: Tangible Non-current Assets

2.1. Type 1: Revenue expenditure vs Capital expenditure (PPE – IAS 16)

Importance: High

|

Question 8: IAS 16 Property, Plant, and Equipment requires an asset to be measured at cost on its original recognition in the financial statements. EW used its own staff, assisted by contractors when required, to construct a new warehouse for its own use. Identify whether the costs listed below should be capitalized or expensed:

|

Guidance:

Students should focus on the objectives of the incurred expenses to identify what that expenses are used for:

|

|

Revenue expenditure |

Capital expenditure |

|

Objectives |

Maintaining daily business operations |

Improving revenue generation capacity |

|

Effects on the related asset |

Keep the asset in working order |

|

Answer:

|

|

Capitalize |

Expense |

|

Clearance of the site prior to commencement of construction |

X |

|

|

Professional surveyor fees for managing the construction work |

X |

|

|

EW’s own staff wages for time spent working on construction |

X |

|

|

A proportion of EW’s administration costs, based on staff time spent |

|

X |

- The allocation of EW’s administration costs would not be accounted as a capital expenditure.

Because these costs are only incurred after the construction work, thus they do not improve the warehouse’s capacity.

- The rest are costs incurred when the warehouse is being built.

|

Question 9: On 1 January 20X7, Z Co purchased an item of plant. The invoice showed:

Modifications to the factory building costing $2,200 were necessary to enable the plant to

|

Guidance:

Step 1: Students should focus on the objectives of the incurred expenses to identify what that expenses are used for:

|

|

Revenue expenditure |

Capital expenditure |

|

Objectives |

Maintaining daily business operations |

Improving revenue generation capacity |

|

Effects on the related asset |

Keep the asset in working order |

|

Step 2: Exclude the revenue expenditures when summing all capital expenditures.

Answer: $50,600

Step 1: Notice that the warranty cost cannot be capitalized. This is a post-purchased expense that is used for fixing problems occurred in daily operations or maintaining the plant.

The rest are costs incurred when the plant is being installed, which qualified to be capitalized for the plant in Z Co’s accounting records.

Step 2: Calculate the total value of the plant

|

|

$ |

|

Cost of plant |

48,000 |

|

Delivery to factory |

400 |

|

Modifications |

2,200 |

2.2. Type 2: Depreciation, Depreciation method, Useful life, Residual Value (PPE – IAS 16)

Importance: High

|

Question 10: Drexler acquired an item of the plant on 1 October 20X2 at a cost of $500,000. It has a useful life of five years (straight-line depreciation) and an estimated residual value of 10% of its historical cost or current cost as appropriate. As of 30 September 20X4, the manufacturer of the plant still makes the same item of plant and its current price is $600,000. What is the correct carrying amount to be shown in the statement of financial position of Drexler as at 30 September 20X4 under historical cost and current cost?

|

Guidance:

Remember these formulas:

- Carrying amount = Cost – Depreciation

- Annual Depreciation (straight-line method) = (Cost – Residual value)/Useful life

Answer: B

|

|

Historical cost |

Current cost |

|

$'000 |

$'000 |

|

|

Cost/Valuation |

500 |

600 |

|

Depreciation [(500,000 × 90%) /5] × 2 |

(180) |

|

|

Depreciation [(600,000 × 90%) /5] × 2 |

|

(216) |

|

|

––––––– |

––––––– |

|

Carrying amount |

320 |

384 |

|

|

––––––– |

––––––– |

|

Question 11: An aircraft has the following components:

Calculate depreciation at the end of the first year, in which 150 flights totaling 400 hours were made.

|

Guidance:

These are properties that are formed from separate ingredients. Each component is depreciated over its own useful life.

Answer: $4,500,000

|

|

$’000 |

|

Fuselage = (20,000 * 1/20) |

1,000 |

|

Undercarriage = (5,000 * 150/500) |

1,500 |

|

Engines (8,000 * 400/1600) |

2,000 |

|

|

––––––– |

|

Depreciation charge |

4,500 |

|

Question 12: On 1 July 20X4, Experimenter opened a chemical reprocessing plant. The plant was due to be active for five years until 30 June 20X9, when it would be decommissioned. At 1 July 20X4, the costs of decommissioning the plant were estimated to be $4 million in 5 years’ time. The experimenter considers that a discount rate of 12% is appropriate for the calculation of a present value, and the discount factor at 12% for five years is 0.567. What is the total charge to the statement of profit or loss in respect of the decommissioning for the year ended 30 June 20X5? A. $453,600 B. $725,760 C. $800,000 D. $2,268,000 |

Guidance:

Remember:

- IAS 16 – Property, Plant, and Equipment: assets are initially measured at cost. This means all directly attributable costs of bringing the asset to the ready-to-use condition will be added into the asset initial value, along with purchase price and all relevant duties and obligations.

In this case, students should identify whether the decommissioning costs related to the acquisition of the plant.

- When measuring money at a future time, students should discount all future sums of money or stream of cash flows to their current value, given a specified rate of return/discount rate. The present value is calculated by multiplying the expected future cost by a discount factor.

Answer: B

The cost of the decommissioning is assumed to be an obligation for the entity. An amount should be included in the cost of the asset when it is first recognized (1 July 20X4). The amount to include in the cost of the asset for decommissioning costs is the present value of the expected future decommissioning costs.

The present value is calculated by multiplying the expected future cost by a discount factor, which in this case is the discount factor for Year 5 (20X9) at 12%: $4 million × 0.567 = $2.268 million.

All relevant costs related to the decommissioning which will be charged in the year ended 30 June 20X5 are:

|

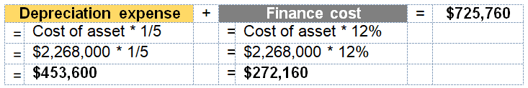

Depreciation expense |

Incurred every year (Straight‐line basis over 5 years), in respect of the initial cost of the plant. |

|

|

|

|

Finance cost |

Incurred every year due to cost of capital (12%) |

Therefore, the total charge to the statement of profit or loss in respect of the decommissioning for the year ended 30 June 20X5:

|

Notes to students: · If you selected A, you have included the depreciation without the finance cost. · If you selected C, you have just spread the present value of the dismantling over 5 years. · If you selected D, you have expensed the whole asset value. |

2.3. Type 3: Revaluation model (PPE – IAS 16)

Importance: High

|

Question 13: State whether each of the following statements is true or false. Statement 1: If the revaluation model is used for property, plant, and equipment, all items of property, plant, and equipment must be subject to revaluation. Statement 2: When an item of property, plant, and equipment is revalued, it is compulsory to make the annual transfer of excess depreciation within equity.

|

Guidance:

Remember:

- Revaluation model according to IAS 16:

- Revaluations should be made with sufficient regularity to ensure that the carrying amount of the assets remains close to fair value.

- If one item in a class of assets is revalued, all the assets in that class must be revalued.

- The depreciation charge:

The depreciation charge on the revalued asset will be different to the depreciation that would have been charged based on the historical cost of the asset. As a result of this, IAS 16 permits a transfer to be made of an amount equal to the excess depreciation from the revaluation reserve to retained earnings.

Tips:

- When seeing the word “all”, be extremely careful with the statement, as it may be TRICKY!

- BE CAREFUL, in the exam, a reserves transfer is only required if the examiner indicates that it is company policy to make a transfer to realized profits in respect of excess depreciation on revalued assets. If this is not the case, then a reserves transfer is not necessary.

Answer:

|

|

Statement 1 |

Statement 2 |

|

True |

|

|

|

False |

Statement 1: IAS 16 requires that, if the revaluation model is adopted, all items of the same class must be accounted for on the same basis. However, it is possible for, e.g. land and buildings to be accounted for using the revaluation model, whilst other classes of property, plant, and equipment (e.g. plant and equipment) to be accounted for using the cost model.

Statement 2: The annual transfer of “excess depreciation” is an accounting policy choice made by an entity when it revalues any class of property, plant, and equipment. It is optional, not compulsory.

Note that however, that if this treatment is adopted, it must be applied every year, rather than applied some years and not in other years.

|

Question 14: The following information of Premium Co is available for the year ended 31 October 20X2:

On 1 November 20X1, P Co revalued the property to $120,000. Premium Co’s accounting policy is to charge depreciation on a straight‐line basis over 50 years. On revaluation, there was no change to the overall useful life. It has also chosen to make the annual transfer of excess depreciation on revaluation in equity. What should be the balance on the revaluation surplus and the depreciation charge as shown in Premium Co’s financial statements for the year ended 31 October 20X2?

|

Guidance:

Remember:

- Revaluation model according to IAS 16:

- Revaluations should be made with sufficient regularity to ensure that the carrying amount of the assets remains close to fair value.

- If one item in a class of assets is revalued, all the assets in that class must be revalued.

- The depreciation charge:

The depreciation charge on the revalued asset will be different from the depreciation that would have been charged based on the historical cost of the asset. As a result of this, IAS 16 permits a transfer to be made of an amount equal to the excess depreciation from the revaluation reserve to retained earnings.

Tips:

BE CAREFUL, in the exam, a reserves transfer is only required if the examiner indicates that it is company policy to make a transfer to realized profits in respect of excess depreciation on revalued assets. If this is not the case, then a reserves transfer is not necessary.

Answer: A

Calculate the two figures, based on below table:

Depreciation:

|

Depreciation |

Cost (1) |

Useful life (2) |

Annual Depreciation (3) = (1) : (2) |

Accumulated Depreciation (4) |

Depreciated years (5) = (4) : (3) |

|

1 Nov 20X1 |

$102,000 |

50 years |

$2,040 |

$20,400 |

10 |

|

Revaluation |

|||||

|

31 Oct 20X2 |

$120,000 |

40 years |

$3,000 |

$3,000 |

1 |

|

Excess Depreciation |

|

|

$960 |

|

|

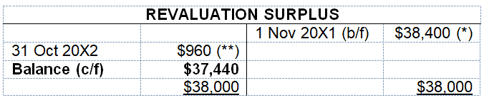

Revaluation surplus:

(*) When revaluing an asset, the revaluation surplus can be identified as the difference between

the revalued amount and the carrying amount of the asset = $38,400 ($120,000 – $81,600).

(**) The excess depreciation will be transferred from revaluation surplus to retained earnings due to P Co’s policy. The amount is $960 ($3,000 – $2,040).

The balance on revaluation surplus at 31 October 20X2 is $37,440.

-1.png?height=120&name=SAPP%20logo%20m%E1%BB%9Bi-01%20(1)-1.png)