Session 1 (Phần 2) sẽ ôn lại 6 dạng bài tập quan trọng môn PFE (Chuẩn bị cho tuyển dụng) với chủ đề Tangible Non-current Assets và Intangible Non-current Assets.

1. Topic 2.1: Tangible Non-current Assets

1.1. Type 4: Disposal (PPE – IAS 16 & Investment Property – IAS 40)

1.2. Type 5: Definition & Fair value model (Investment Property – IAS 40)

1.3. Type 6: Change the intended uses (PPE – IAS 16 & Investment Property – IAS 40)

1.4. Type 7: Borrowing costs (IAS 23) & Government Grants (IAS 20)

2. Topic 2.2: Intangible Non-current Assets

2.1. Type 1: Definition & Recognition of intangible non-current assets (IAS 38)

I. Tổng quan:

|

Topic |

Question types |

Question index |

|

MCQ |

||

|

Tangible Non-current Assets |

4. Disposal (PPE – IAS 16 & Investment Property – IAS 40) |

15, 16 |

|

5. Definition & Fair value model (Investment Property – IAS 40) |

17, 18 |

|

|

6. Change the intended uses (PPE – IAS 16 & Investment Property – IAS 40) |

19, 20 |

|

|

7. Borrowing costs (IAS 23) & Government Grants (IAS 20) |

21, 22 |

|

|

Intangible Non-current Assets |

1. Definition & Recognition of intangible non-current assets (IAS 38) |

23, 24 |

|

2. Research & Development cost |

25, 26 |

II. Dạng bài tập chi tiết:

1. Topic 2.1: Tangible Non-current Assets

1.1. Type 4: Disposal (PPE – IAS 16 & Investment Property – IAS 40)

Importance: High

|

Question 15: On 1 April 20X0 Slow and Steady Co held non-current assets that cost $312,000 and had accumulated depreciation of $66,000 at this date. During the year ended 31 March 20X1, Slow and Steady Co disposed of non-current assets which had originally cost $28,000 and had a carrying amount of $11,200. Slow and Steady Co’s policy is to charge depreciation of 40% on the reducing balance basis, with no depreciation charged in the year of disposal. What is the depreciation charge to the statement of profit or loss for the year ended 31 March 20X1?

|

Guidance:

Step 1: Calculate the carrying amount of the asset.

Step 2: Remove the carrying amount of the disposed of assets from the total carrying amount

Step 3: Calculate the new carrying amount on the day per question.

Step 4: Calculate the depreciation charge, based on the depreciation method per question.

Answer: $93,920

|

|

|

$ |

|

Step 1 |

Carrying amount at 1 April 20X0 ($312,000 cost – $66,000 depreciation) |

246,000 |

|

Step 2 |

Carrying amount of disposal |

(11,200) |

|

|

––––––– |

|

|

Step 3 |

Carrying amount at 31 March 20X1 |

234,800 |

|

Step 4 |

Depreciation charge (40%) |

93,920 |

|

Question 16: An entity purchased the property for $6 million on 1 July 20X3. The land element of the purchase was $1 million. The expected life of the building was 50 years and its residual value nil. On 30 June 20X5, the property was revalued to $7 million, of which the land element was $1.24 million and the buildings $5.76 million. On 30 June 20X7, the property was sold for $6.8 million. What is the gain on disposal of the property that would be reported in the statement of profit or loss for the year to 30 June 20X7? A. Gain $40,000 B. Loss $200,000 C. Gain $1,000,000 D. Gain $1,240,000 |

Guidance:

Remember:

- The property consists of two elements: Land & Building

- Land is not depreciated

- On disposal:

- Proceeds > Net Book Value àGain on disposal

- Proceeds < Net Book Value àLoss on disposal

Step 1: Calculate the carrying amount of the property before the day of revaluation.

Step 2: Calculate the revalued amount of the property.

Step 3: Be cautious that the related depreciation will change, followed by the property revaluation. → Calculate the new depreciation of the property.

Step 4: Calculate the new carrying amount on the day per question.

Step 5: Calculate the profit or loss on the disposal, by subtracting the figure with proceeds.

Answer: A

|

|

|

Land |

Building |

Total |

|

|

|

$ million |

$ million |

$ million |

|

Step 1 |

Cost 1 July 20X3 |

1.00 |

5.00 |

6.00 |

|

Building depreciation |

|

|

|

|

|

= $5 million/50 years = $0.1m per year × 2 |

|

(0.2) |

(0.2) |

|

|

|

––––––– |

––––––– |

––––––– |

|

|

Carrying amount 30 June 20X5 |

1.00 |

4.80 |

5.80 |

|

|

Step 2 |

Revaluation gain |

0.24 |

1.96 |

1.20 |

|

|

––––––– |

––––––– |

––––––– |

|

|

Revalued amount |

1.24 |

5.76 |

7.00 |

|

|

Step 3 |

Building depreciation |

|

|

|

|

= $5.76 million/48 years = $0.12m per year × 2 |

|

(0.24) |

(0.24) |

|

|

Step 4 |

|

––––––– |

––––––– |

––––––– |

|

Carrying amount 30 June 20X7 |

1.24 |

5.52 |

6.76 |

|

|

Step 5 |

|

––––––– |

––––––– |

––––––– |

|

Disposal proceeds |

|

|

6.80 |

|

|

|

|

|

––––––– |

|

|

Gain on disposal |

|

|

0.04 |

|

|

|

|

|

|

––––––– |

=> The gain on disposal is $40,000.

|

Notes to students: The $1.2 million balance on the revaluation reserve is transferred from the revaluation reserve to another reserve account (probably retained earnings) but is not reported through the statement of profit or loss for the year.

|

1.2. Type 5: Definition & Fair value model (Investment Property – IAS 40)

Importance: Average

|

Question 17: Which of the following properties owned by Scoop would be classified as investment property? A. A property that had been leased to a tenant but which is no longer required and is now being held for resale B. Land purchased for its investment potential. Planning permission has not been obtained for building construction of any kind C. A new office building used as Scoop’s head office purchased specifically in order to exploit its capital gains potential D. A stately home used for executive training |

Guidance:

Remember:

IAS 40 – Investment Property is applied to land or building which used for investment purposes, rather than for use in the business.

Those purposes are:

- Earned rental (operating lease)

- Capital appreciation (wait for an increase in price to sell)

Answer: B

- Asset B was purchased for investment potential.

- Asset A would be classed as a non‐current asset held for sale under IFRS 5 Non‐current Assets Held for Sale and Discontinued Operations.

- Assets C and D were purchased for internal use, so they would both be classified as property, plant, and equipment per IAS 16 Property, Plant, and Equipment.

|

Question 18: Croft acquired a building with a 40‐year life for its investment potential of $8 million on 1 January 20X3 On 31 December 20X3, the fair value of the property was estimated at $9 million with costs to sell estimated at $200,000. If Croft Co uses the fair value model for investment properties, what gain should be recorded in the statement of profit or loss for the year ended 31 December 20X3?

|

Guidance:

Remember:

According to IAS 40 – Investment Property, assets used for investment purposes should be accounted for at their latest fair value.

- All changes in fair value should be recognized in the statement of profit or loss (P&L)

- Investment property is not depreciable! (Different from IAS 16 – Property, plant, and equipment)

Answer: $1,000,000

The fair value gain of $1 million ($9m – $8m) should be taken to the statement of profit or

loss. Costs to sell are ignored and, since Croft uses the fair value model, no depreciation will

be charged on the building.

1.3. Type 6: Change the intended uses (PPE – IAS 16 & Investment Property – IAS 40)

Importance: Average

|

Question 19: Smithson Co purchased a new building with a 50‐year life for $10 million on 1 January 20X3. On 30 June 20X5, Smithson Co moved out of the building and rented it out to third parties on a short‐term lease Smithson Co uses the fair value model for investment properties. On 30 June 20X5 the fair value of the property was $11 million and at 31 December 20X5 it was $11.5 million. What is the total net amount to be recorded in the statement of profit or loss in respect of A. Net income $400,000 B. Net income $500,000 C. Net income $1,900,000 D. Net income $2,000,000 |

Guidance:

Remember:

According to IAS 40 – Investment Property, assets used for investment purposes should be accounted for at their latest fair value.

- All changes in fair value should be recognized in the statement of profit or loss (P&L)

- Investment property is not depreciable! (Different from IAS 16 – Property, plant, and equipment)

About the changes in intended uses:

|

From |

To |

Accounting treatment |

|

IP |

PPE |

DR: PPE - Fair value at the transfer day CR: IP - Fair value at the transfer day |

|

PPE |

IP |

DR: IP - Fair value at the transfer day CR: PPE - Carrying amount at the transfer day CR: Revaluation surplus (DR: P&L if PPE is impaired) |

Answer: A

Before lending the building out, it itself was valued under IAS 16. When the building was leased, it was transferred into an investment property. So it would be accounted for under IAS 40, which requires that asset must be transferred across at the fair value at the date of transfer ($11m per question).

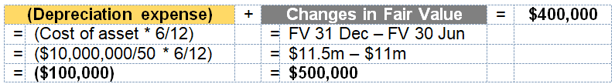

All costs which will be charged in the year ended 31 December 20X5 are:

|

Depreciation expense |

6 months’ depreciation accounted for up to 30 June 20X5 |

|

|

|

|

Changes in Fair value |

From 30 June 20X5, the asset will be revalued to fair value with gains or losses going through the statement of profit or loss |

Therefore, the total charge to the statement of profit or loss in respect of the building for the year ended 30 June 20X5:

|

Question 20: Carter vacated an office building and let it out to a third party on 30 June 20X8. The building had an original cost of $900,000 on 1 January 20X0 and was being depreciated over 50 years. It was judged to have a fair value on 30 June 20X8 of $950,000. At the year-end date of 31 December 20X8, the fair value of the building was estimated at $1.2 million. Carter uses the fair value model for investment property. What amount will be shown in the revaluation surplus on 31 December 20X8 in respect of this building?

|

Guidance:

Remember:

According to IAS 40 – Investment Property, assets used for investment purposes should be accounted for at its latest fair value.

- All changes in fair value should be recognized in the statement of profit or loss (P&L)

- Investment property is not depreciable! (Different from IAS 16 – Property, plant, and equipment)

Answer: $203,000

Before lending the office building out, it itself was valued under IAS 16. When the building was leased, it was transferred into an investment property. So it would be accounted for under IAS 40, which requires that asset must be transferred across at the fair value at the date of transfer ($950,000 per question)

|

$'000 |

|

|

Cost (1.1.20X0) |

900 |

|

Depreciation to 30.6.20X8 (900,000 × 8.5/50) |

(153) |

|

|

––––––– |

|

Carrying amount 30.6.20X8 |

747 |

|

Revaluation surplus |

203 |

|

Fair value (30.6.20X8) |

950 |

|

Notes to students: The increase in fair value of $250,000 (= $1,200,000 - $950,000) arising between 30.6.20X8 and 31.12.20X8 will be charged to P&L, according to IAS 40. |

1.4. Type 7: Borrowing costs (IAS 23) & Government Grants (IAS 20)

Importance: Average

|

Question 21: Apex Co issued the loan stock on 1 April 20X8. Three events or transactions must be taking place for capitalization of borrowing costs to commence in accordance with IAS 23. Which of the following is NOT one of these? A. Expenditure on the asset is being incurred. B. Borrowing costs are being incurred. C. Physical construction of the asset is nearing completion. D. Necessary activities are in progress to prepare the asset for use or sale |

Guidance:

Remember:

IAS 23 has no requirements in respect of the stage of completion of the asset.

Answer: C

|

Question 22: Which TWO of the following statements about IAS 20 Accounting for Government Grants and Disclosure of Government Assistance are true? A. A government grant related to the purchase of an asset must be deducted from the carrying amount of the asset in the statement of financial position. B. A government grant related to the purchase of an asset should be recognized in profit or loss over the life of the asset. C. Free marketing advice provided by a government department is excluded from the definition of government grants. D. Any required repayment of a government grant received in an earlier reporting period is treated as a prior period adjustment |

Guidance:

Remember:

There are 2 ways to recognize the Grants that related to assets:

- Recognize the grant as deferred income

- Deduct the grant in arriving at the carrying amount of the asset

Services from the government (Example: Free marketing advice) is treated as Government assistance

Any repayment is corrected in the current period, not retrospectively

Answer: B & C

- Item A is incorrect as the deferred income method can be used.

- Item D is incorrect as any repayment is corrected in the current period (not the prior period)

2. Topic 2.2: Intangible Non-current Assets

Importance: High

2.1. Type 1: Definition & Recognition of intangible non-current assets (IAS 38)

Importance: High

|

Question 23: Which of the following statements relating to intangible assets is true? A. All intangible assets must be carried at amortized cost or at an impaired amount, they cannot be revalued upwards. B. The development of a new process that is not expected to increase sales revenues may still be recognized as an intangible asset. C. Expenditure on the prototype of a new engine cannot be classified as an intangible asset because the prototype has physical substance. D. The title heading, font, and design of the front page of a major broadsheet newspaper are for capitalization as intangible assets |

Guidance:

Students should focus on the effects of the incurred expenses to identify what that expenses are used for. Then access them to identify whether they meet all the below criteria:

- Probable future economic benefit

- Intention to complete and use or sell the asset

- Resources adequate and available to complete and use or sell the asset

- Ability to use or sell the asset

- Technical feasibility

- Expenditures can be reliably measured

If the cost satisfies all 6 conditions, it can be capitalized as intangible non-current assets.

Answer: B. Because the new process still can produce benefits by reducing costs, not necessarily increasing revenues.

- Statement A is incorrect because intangible assets can be carried at cost model or revaluation model.

- Statement C is incorrect because the prototype’s expenses might be classified as an intangible asset if it satisfies all criteria to be a development cost.

- Statement D is incorrect because the title heading, font, and design cannot be measured reliably.

|

Question 24: Amco Co carries out research and development. In the year ended 30 June 20X5 Amco Co incurred total costs in relation to project X of $750,000, spending the same amount each month up to 30 April 20X5, when the project was completed. The product produced by the project went on sale from 31 May 20X5. The project had been confirmed as feasible on 1 January 20X5, and the product produced by the project was expected to have a useful life of five years. What is the carrying amount of the development expenditure asset as at 30 June 20X5? A. $295,000 B. $725,000 C. $300,000 D. $0 |

Guidance:

- If an asset is confirmed to be an intangible asset on a specific date during the financial year, the costs arising from this date can be capitalized.

- When an asset begins to involve in commercial activities, or available to use, it must be amortized from that moment.

Answer: A

The costs of $750,000 related to 10 months of the year (from 1 July 20X4 to 30 April 20X5). Therefore, the costs per month were $75,000.

As the project was confirmed as feasible on 1 January 20X5, the costs can be capitalized from this date. So, four months of these costs can be capitalized = $75,000 × 4 = $300,000.

The asset should be amortized from when the products go on sale, so one month’s amortization should be charged to 30 June 20X5. Amortization is ($300,000/5) ×1/12= $5,000. The carrying amount of the asset on 30 June 20X5 is $300,000 – $5,000 = $295,000.

2.2. Type 2: Research & Development cost

Importance: High

|

Question 25: Which of the following could be classified as development expenditure in M’s statement of financial position as of 31 March 20Y0 according to IAS 38 Intangible Assets? A. $120,000 spent on developing a prototype and testing a new type of propulsion B. A payment of $50,000 to a local university’s engineering faculty to research new C. $35,000 developing an electric bicycle. This is near completion, and the product will be launched soon. As this project is the first of its kind it is expected to make a loss. D. $65,000 developing a special type of new packaging for a new energy‐efficient light |

Guidance:

Remember:

- Research cost: written off as an expense as incurred.

- Development cost: Recognized as an asset if they meet all certain criteria:

- Probable future economic benefit

- Intention to complete and use or sell the asset

- Resources adequate and available to complete and use or sell the asset

- Ability to use or sell the asset

- Technical feasibility

- Expenditures can be reliably measured

If not, it should be expensed off.

Answer: D

- Item A cannot be capitalized because it does not meet all the criteria as it is not viable.

- Item B is research and cannot be capitalized.

- Item C cannot be capitalized because it does not meet all the criteria as it is making a loss.

|

Question 26: Assoria Co had $20 million of capitalized development expenditure at cost brought forward on 1 October 20X7 in respect of products currently in production and a new project began on the same date. The research stage of the new project lasted until 31 December 20X7 and incurred $1.4 million of costs. From that date, the project incurred development costs of $800,000 per month. On 1 April 20X8, the directors of Assoria Co became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development on 30 September 20X8. Capitalized development expenditure is amortized at 20% per annum using the straight-line method. What amount will be charged to profit or loss for the year ended 30 September 20X8 in respect of research and development costs? A. $8,280,000 B. $6,880,000 C. $7,800,000 D. $3,800,000 |

Guidance:

Remember:

- Research cost: written off as an expense as incurred.

- Development cost: Recognized as an asset if they meet all certain criteria:

- Probable future economic benefit

- Intention to complete and use or sell the asset

- Resources adequate and available to complete and use or sell the asset

- Ability to use or sell the asset

- Technical feasibility

- Expenditures can be reliably measured

If not, it should be expensed off.

Step 1: Identify the cost incurred in the period

Step 2: Identify the cost that should be capitalized

Step 3: Amount will be charged to P/L = Step 1 - Step 2

Answer: C

Astoria Co is implementing 2 projects:

- Old project: Depreciation on capitalized amount b/f ($20m × 20%) =$4m à P/L

- New project:

Research phase from 1 October 20X7 to 31 December 20X7 and incurs $ 1.4m in costs à P/L

On 1 April 20X8 the directors of Assoria Co became confident that the project would be successful and yield a profit well in excess of costs → Research costs recorded from April 1, 20X8 to the end of the period ended September 30, 20X8 (6 months) will be capitalized into asset value and not costs during the period.

→ Total development cost is recognized as a cost during the period = $800,000 * 3 = $2.4m → P/L

-1.png?height=120&name=SAPP%20logo%20m%E1%BB%9Bi-01%20(1)-1.png)